Blog

Finding the Right Path: Professional Help vs. Going Solo

When disaster strikes your home, insurance repair contractors are specialized professionals who handle property restoration after damage covered by insurance policies. They provide a complete solution from emergency response through final repairs.

Insurance Repair Contractor Options at a Glance:

- Insurance-recommended contractors - Often part of managed repair networks like Contractor Connection or Sedgwick

- Independent restoration contractors - Specialized in water, fire, or mold damage

- Design-build contractors - Combining restoration with remodeling services

Note: While insurance companies may suggest preferred vendors, homeowners have the legal right to choose any qualified contractor for repairs.

The moment water floods your basement or fire damages your kitchen, you face a critical decision: hire professional insurance repair contractors or tackle the restoration yourself. This choice affects everything from your claim settlement to the quality of repairs and your family's safety. With insurance deductibles rising and the average homeowner facing complex repair processes, understanding your options has never been more important.

Many Denver homeowners initially consider DIY approaches to save money, but often underestimate the specialized knowledge required for proper insurance restoration. From emergency water extraction to navigating code requirements, the expertise gap can be substantial. According to industry data, professional contractors handle over 500,000 insurance restoration assignments annually through managed repair networks alone.

I'm Mike Martinez, owner of Accountable Home Services, with over 15 years of experience working as one of Denver's trusted insurance repair contractors specializing in water, fire, and mold restoration projects. I've guided hundreds of homeowners through the insurance claim repair process, helping them steer the complexities while ensuring quality workmanship.

Why This Debate Matters

The decision between hiring insurance repair contractors or going DIY isn't just about cost—it's about stress levels, timeline management, and ultimately, the quality of your home's restoration. With the average insurance deductible now ranging between $1,000-$2,500 for many Colorado homeowners, the financial stakes are significant.

"Nobody wants to find themselves in the position of needing to file a homeowner's insurance claim," as industry experts note. When you're already dealing with the emotional impact of property damage, the last thing you need is the added pressure of navigating complex restoration processes alone.

For Denver homeowners, this debate carries particular weight due to our unique climate challenges—from flash floods to winter pipe bursts to wildfire concerns. The right decision can mean the difference between a smooth recovery and months of headaches.

Understanding the Insurance Repair Landscape

When your home suffers damage, you're suddenly thrust into the unfamiliar world of insurance claims and restoration. It's a bit like learning a new language while under extreme stress.

The first thing to understand is that insurance companies rely on specialized software called Xactimate to determine repair costs. While this industry-standard tool is thorough, it often produces estimates that run lower than what you might see with other construction estimating methods. As one restoration professional put it to me recently, "It's not the insurance adjuster's job to provide you with the amount of money you need for high-quality repairs." They're working to settle claims efficiently, not necessarily to ensure you get premium materials or finishes.

The insurance restoration process breaks down into two key phases that many homeowners don't initially recognize:

- Remediation - This is the immediate response work: extracting standing water, drying structures, preventing mold growth, or boarding up after fire damage. This phase focuses on preventing further damage.

- Repair - This reconstruction phase restores your property to its pre-loss condition, replacing damaged materials and finishes.

Many DIY-minded homeowners focus on the repair phase, thinking about new drywall and paint, without fully appreciating the technical requirements of proper remediation. Without professional moisture mapping or proper drying equipment, hidden damage can linger behind walls, setting the stage for future problems.

According to research from J.D. Power, homeowner satisfaction with the claims process drops significantly when restoration takes longer than expected or requires multiple visits to address overlooked issues.

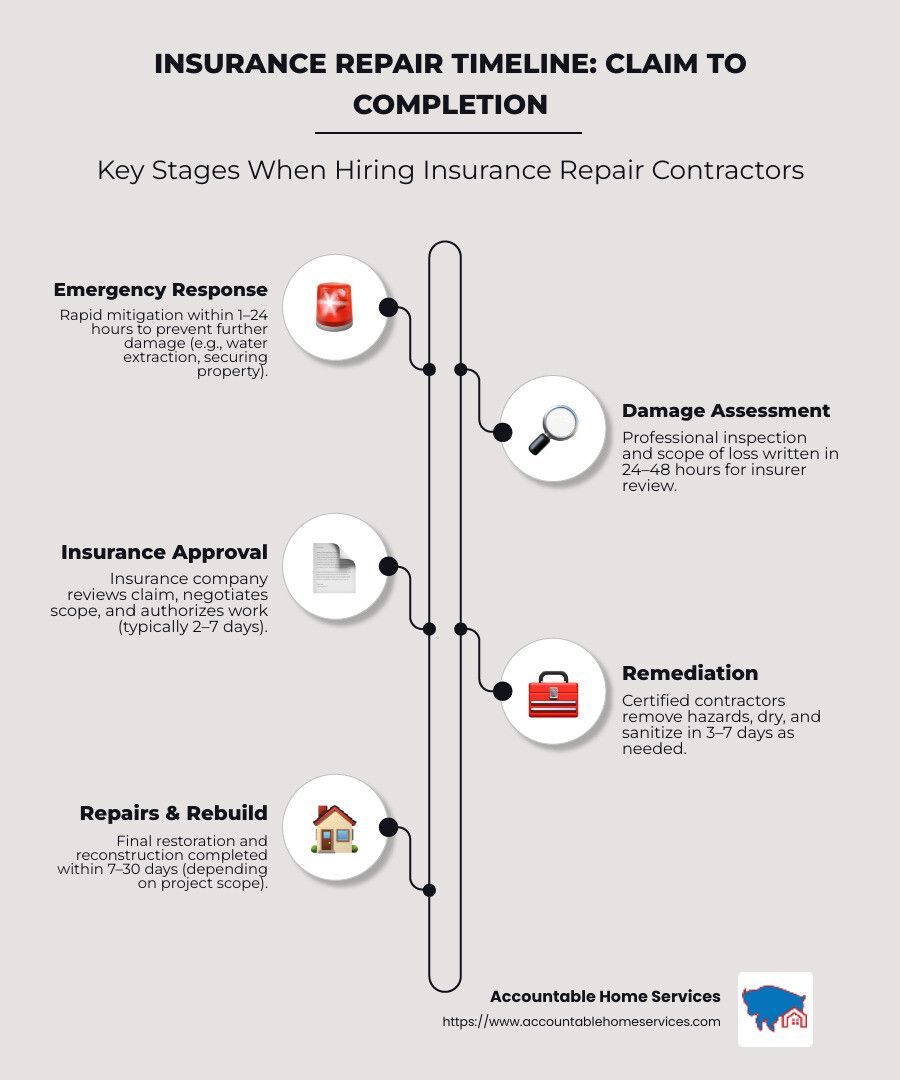

From First-Notice-of-Loss to Final Inspection

The journey from reporting your claim to completing repairs follows a relatively standard path, regardless of who handles the work:

When disaster strikes, your first call should be to your insurance company to report the damage. This is called the "First-Notice-of-Loss" or FNOL. You'll need to document everything with photos and videos before any cleanup begins.

Next comes the damage assessment. Your insurance adjuster will visit to evaluate the damage and create an initial scope of work using Xactimate. This document becomes the foundation for your entire claim.

The remediation phase begins immediately after—or sometimes before—the adjuster's visit. This is when insurance repair contractors extract water, set up drying equipment, or secure your property against further damage.

Once remediation is complete, you'll review the insurance company's scope of work. This is a critical moment where insurance repair contractors can identify items missing from the initial assessment and request "supplements" to cover these additional costs.

The actual repair and reconstruction work follows, bringing your property back to its pre-loss condition. Many homeowners don't realize that this phase often requires multiple supplements as hidden damage is finded during repairs.

Finally, the insurance company conducts a final inspection to verify completed work before releasing your final payment, including any recoverable depreciation (the portion of your claim initially withheld to ensure you complete the repairs).

Throughout this process, professional contractors familiar with insurance work steer each step efficiently. DIYers often struggle with documentation, code compliance, and the supplement process—which can mean leaving money on the table.

Managed Repair Networks 101

If you've filed a claim recently, your insurer likely mentioned their "preferred vendors" or a managed repair program. These networks—like Contractor Connection, Sedgwick, Accuserve, and tradePRO—are becoming increasingly common in the insurance world.

These managed repair networks operate as middlemen between insurance companies and contractors. They pre-screen restoration companies and streamline the claims process, offering some impressive benefits:

Contractor Connection alone handles more than 500,000 restoration projects annually, representing over $3 billion in project costs. Their network includes more than 6,000 vetted contractors nationwide, and they maintain an impressive 85.4 net promoter score from customers.

The advantages of using these network contractors include quick response times (usually within 24 hours), multi-year workmanship warranties (typically 3-5 years), convenient digital project tracking, and direct billing to your insurance company. For many homeowners, this simplifies an otherwise complex process.

However, there's an important consideration here. As one industry expert notes, "Insurance-recommended contractors are incentivized to minimize costs and may cut corners or perform unqualified work." These contractors operate under strict guidelines to keep costs down, which can sometimes conflict with delivering the highest quality restoration.

At Accountable Home Services, we understand both sides of this equation. While we work with several managed repair networks, we maintain our independence and quality standards, ensuring Denver homeowners receive restoration work that truly stands the test of time—not just meets minimum requirements.

Insurance Repair Contractors—Worth the Cost?

When water is pouring through your ceiling at 2 AM or smoke damage has left your home unlivable, the value of professional help becomes crystal clear. Insurance repair contractors bring a level of expertise to your restoration project that simply can't be matched by even the most dedicated DIY enthusiast.

At Accountable Home Services, our team doesn't just show up with a mop and bucket. We arrive with years of specialized training, industrial-grade equipment, and a deep understanding of both the science behind proper restoration and the maze of insurance paperwork that follows.

Our technicians hold certifications from the Institute of Inspection, Cleaning and Restoration Certification (IICRC) in water damage restoration, fire and smoke remediation, and mold remediation. This isn't just about hanging certificates on our wall—it's about understanding the chemistry of smoke damage, the physics of moisture movement through building materials, and the biology of mold growth. This specialized knowledge makes all the difference between a quick-fix and a lasting restoration.

Pros of Hiring Insurance Repair Contractors

The middle of a crisis is no time to learn a new skill. When Denver homeowners choose professional insurance repair contractors like our team, they're buying peace of mind along with expertise.

24/7 emergency response means you're never facing disaster alone. At Accountable Home Services, we promise one-hour on-site response for water emergencies throughout the Denver Metro area, because we know that every minute counts when water is damaging your home.

Specialized equipment is another critical advantage professionals bring to the table. Our commercial-grade dehumidifiers, air scrubbers, moisture meters, and thermal imaging cameras can detect and address damage that remains invisible to the naked eye. These tools aren't just expensive to purchase—they require training to operate effectively.

Insurance expertise might be the most underrated benefit of working with professionals. We speak the language of adjusters and understand how to document damage properly, create accurate scopes of work, and negotiate for fair settlements. As one relieved homeowner told us after we handled their claim: "This was the most seamless experience in my entire life. I didn't have to doubt what was the next step."

Code compliance matters more than many homeowners realize. Denver's building codes regularly update, and professional contractors stay current with these changes. When we complete your restoration, you can rest assured that all work meets or exceeds current requirements—something that could save you significant headaches during future home sales or inspections.

Workmanship warranties provide lasting protection. At Accountable Home Services, we stand behind our work with a 5-year workmanship warranty on all insurance repairs—far longer than the industry standard.

Direct insurance billing removes a major stress point for homeowners. Rather than paying out-of-pocket and waiting for reimbursement, our team works directly with your insurance company to minimize your financial burden during an already stressful time.

Cons & Caveats of Using Insurance-Preferred Vendors

While insurance-recommended contractors offer convenience, I've seen enough restoration projects to recognize some potential pitfalls worth considering.

Cost-cutting incentives can sometimes influence quality. Some insurance-preferred vendors negotiate deeply discounted rates with insurers, creating pressure to complete jobs quickly and inexpensively. As one industry expert candidly noted, "Preferred vendors negotiate rates that may favor insurers over quality homeowner service."

Limited material choices are another common frustration. Many insurance-preferred contractors work with predetermined material selections that prioritize cost efficiency over matching your home's existing finishes or your personal preferences.

Potential conflicts of interest arise when a contractor's primary relationship is with the insurance company rather than you. When contractors depend on insurers for steady work, their loyalty may be divided when disagreements about scope or quality arise.

Overhead & profit disputes can create unexpected financial burdens. Some insurance companies systematically resist paying overhead and profit on certain aspects of restoration work. This practice became so problematic that in one notable case, "Allstate paid $335,000 to settle a dispute over $33,000 in denied overhead and profit charges" after a contractor challenged their blanket denial policy.

Choosing Your Own Insurance Repair Contractors

Here's something many adjusters won't volunteer: you have the legal right to select any qualified contractor for your insurance repairs. The choice is yours, not your insurance company's.

When selecting your own insurance repair contractor, start by verifying credentials. Look for proper licensing, insurance, and industry certifications like IICRC, HAAG, or other specialized training. Ask potential contractors about their experience with insurance projects similar to yours, and don't hesitate to request references from past clients.

Understanding a contractor's process is equally important. How quickly do they respond to emergencies? How do they document damage for insurance purposes? What steps do they take to prevent secondary damage like mold growth? A reputable contractor will have clear answers to these questions.

Warranty coverage varies widely among contractors, so make sure you understand exactly what guarantees you'll receive on workmanship. Communication style matters too—will you have a dedicated project manager? How frequently will you receive updates? At Accountable Home Services, we believe in transparent communication throughout the restoration process, assigning each client a dedicated project manager who serves as their advocate with the insurance company.

For more detailed information about navigating the insurance repair process, check out our guide on Insurance Insights: A Contractor's Guide to Working with Insurers.

Finding the right balance between quality, service, and cost is the key to a successful restoration project. When disaster strikes your Denver home, having a trusted insurance repair contractor on your side can make all the difference between a stressful ordeal and a smooth recovery process.

DIY Restoration—Is Sweat Equity Enough?

There's something undeniably appealing about rolling up your sleeves and tackling home repairs yourself. I've seen many Denver homeowners consider the DIY route after water or fire damage, especially when faced with high deductibles. The thought process makes sense at first glance—you maintain complete control, potentially save on labor costs, and work according to your own timeline.

But here's the reality I've witnessed over 15 years in this business: DIY insurance restoration is far more complex than your typical weekend home improvement project.

Professional water damage restoration requires specialized equipment most homeowners simply don't have access to. Those industrial dehumidifiers, air movers, and moisture meters you see our teams bringing in? They're not just fancy gadgets—they're essential tools designed to properly dry structures and prevent secondary damage. Renting this equipment is possible, but at $200-500 per day, those rental fees add up quickly.

Safety concerns also can't be overlooked. I've walked into too many situations where well-meaning homeowners were unknowingly exposing themselves to serious hazards. Water damage often involves contaminated water carrying bacteria and pathogens. Fire damage can release toxic chemicals. And let's not forget potential structural instability, electrical hazards, or disturbing materials containing asbestos—particularly common in older Denver homes.

Documentation presents another significant hurdle. As one restoration expert warns, "Cleaning or tidying before documentation can invalidate insurance claims by destroying evidence." Insurance companies require detailed, professional-level documentation of both damage and repairs—something most homeowners aren't equipped to provide.

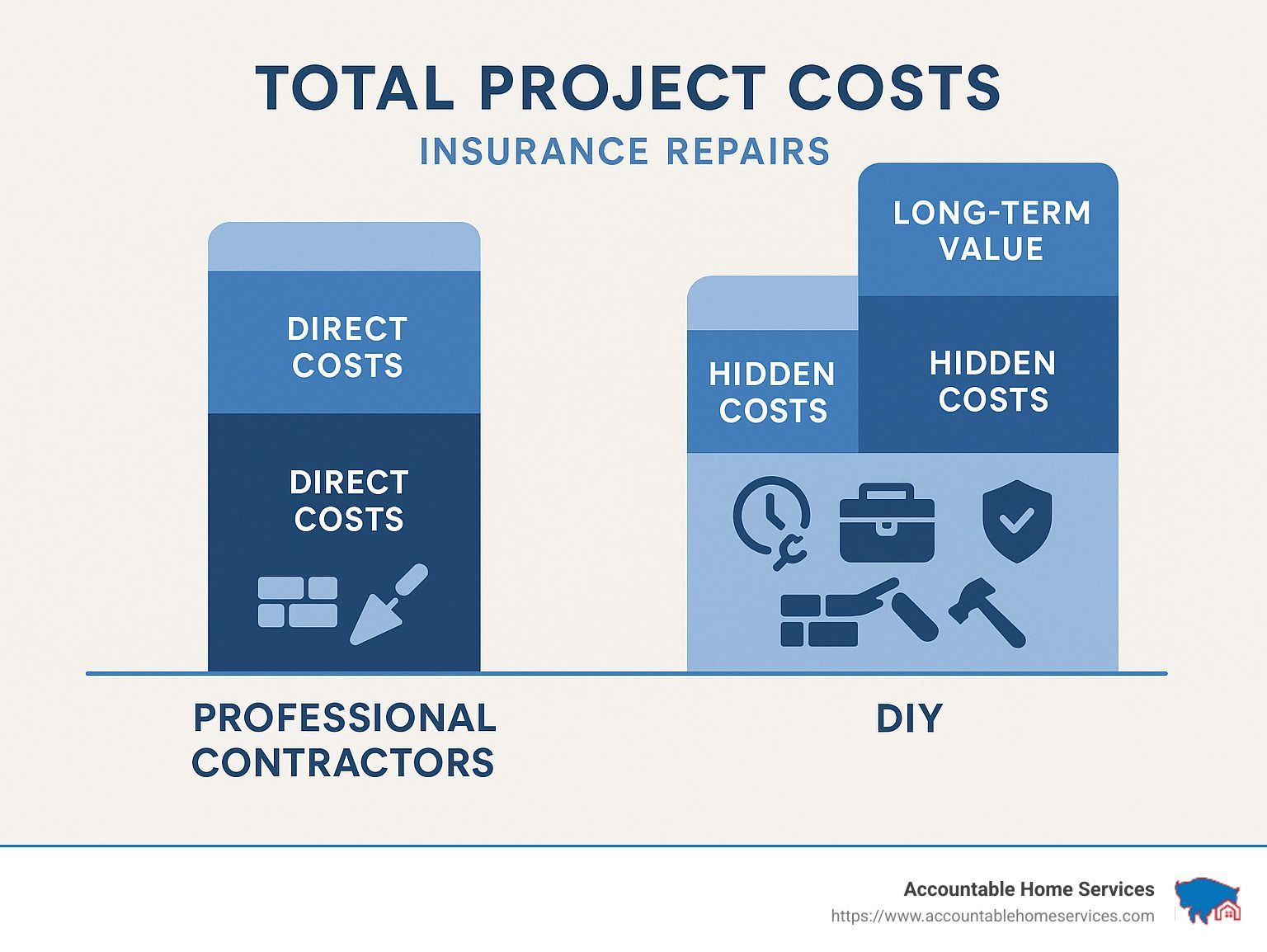

Hidden Costs & Liability Risks

The financial equation for DIY restoration isn't nearly as straightforward as many homeowners initially believe. Beyond equipment rental costs, I've seen countless cases where inexperience led to material wastage and costly rework.

Building code violations are particularly troublesome in Denver, where codes regularly update to address our unique climate challenges. These violations can result in fines and forced rework that your insurance likely won't cover.

Perhaps the most concerning hidden cost is the potential health impact. I've worked with families who developed respiratory issues after improperly handling mold removal, or who finded too late that they'd disturbed asbestos-containing materials during their DIY repairs.

One of the most common problems I see is incomplete drying after water damage. Without professional moisture detection equipment, it's nearly impossible to identify hidden moisture in walls, under floors, or in other concealed spaces. As I often tell our Denver clients, "Water causes huge amounts of damage; the longer it sits, the worse it gets." That hidden moisture frequently leads to mold growth and structural issues weeks or months later—long after your insurance claim has closed.

The supplement process presents another challenge for DIY restorations. When unexpected issues arise mid-project (and they almost always do), insurance repair contractors know how to document and submit supplemental claims for additional funds. DIYers often struggle with this process, leaving them to cover these costs out-of-pocket.

When DIY Makes Sense (and When It Doesn't)

I'm not suggesting DIY is never appropriate—there are certainly situations where taking on repairs yourself can make sense.

DIY might work well for very minor, purely cosmetic damage that falls well below your deductible. If you're replacing a few baseboards or touching up paint after a small water leak that was caught immediately, you might reasonably handle this yourself.

Non-structural repairs that you have genuine experience with can also be DIY-friendly. If you're a skilled weekend woodworker with proper tools and safety knowledge, you might successfully repair damaged cabinets or trim.

But there are definite scenarios where calling in professionals isn't just advisable—it's essential. Water damage affecting multiple materials or rooms requires professional attention to ensure proper drying and prevent mold growth. Any mold situation beyond a very small, isolated area demands professional remediation to prevent cross-contamination and health issues.

Fire and smoke damage is particularly tricky because it requires specialized cleaning techniques to address invisible smoke particles and neutralize odors. And structural damage of any kind should always be handled by licensed professionals who understand load-bearing requirements and building codes.

Time-critical situations also call for professional help. When every hour counts to prevent secondary damage, our 24/7 emergency response team can deploy industrial equipment immediately, potentially saving thousands in additional damage.

In Colorado, there's one situation where DIY isn't just inadvisable—it's illegal. Any asbestos abatement work must be performed by certified professionals. Our state has strict regulations around asbestos handling for good reason, as improper removal can release dangerous fibers into your home's air.

The decision between DIY and hiring insurance repair contractors ultimately comes down to honestly assessing the scope of damage, your own skills and equipment, and the potential risks involved. While the upfront cost savings of DIY might seem attractive, the long-term consequences of improper restoration often far outweigh those initial savings.

Insurance Repair Contractors Timeline

When you work with professional insurance repair contractors like our team at Accountable Home Services, you're tapping into a well-oiled machine designed to get your life back to normal as quickly as possible.

Our restoration process follows what we call the "1-8-24" standard—we'll contact you within 1 hour of your call, have technicians on-site within 8 business hours, and provide a comprehensive estimate within 24 hours. This rapid response isn't just about convenience—it's about preventing secondary damage that can double or triple your restoration costs.

What many homeowners don't realize is how much happens behind the scenes. While our technicians are setting up drying equipment, our project managers are already documenting damage and communicating with your insurance adjuster. These established relationships with insurance companies often help expedite approvals that might otherwise get stuck in bureaucratic limbo.

I remember helping a family in Highlands Ranch after a washing machine overflow. The mother told me afterward, "Having professionals handle everything from the initial water extraction to the final paint touch-ups meant I could focus on keeping my family's routine normal instead of spending weeks trying to figure out restoration techniques." That's exactly what we aim for—handling the technical details so you can focus on what matters most.

Our five-year workmanship warranty also gives homeowners peace of mind that simply isn't available with DIY work. If something isn't right, we'll make it right—no questions asked.

DIY Timeline Realities

I've seen many motivated homeowners start restoration projects with the best intentions, only to find themselves overwhelmed as days turn into weeks and weeks into months.

DIY restoration projects almost always take significantly longer than professional work for several practical reasons. First, there's the steep learning curve—each restoration technique requires research and practice. What takes our certified technicians minutes to accomplish might take a homeowner hours of YouTube videos and trial-and-error.

Most homeowners can only work sequentially on one phase at a time, while our teams can handle multiple aspects of restoration simultaneously. And let's be realistic about availability—if you're working a full-time job, you're limited to evenings and weekends, instantly stretching your timeline.

The equipment factor is another major timeline consideration. Professional water damage restoration follows a scientific drying process that requires monitoring moisture levels in different materials. Without moisture meters and thermal imaging cameras, DIYers often think areas are dry when they still contain dangerous levels of moisture. By the time you notice the musty smell, you're already dealing with a mold problem that could have been prevented.

One Denver homeowner I worked with tried handling a small basement flood himself. Three weeks later, he called us when he finded black mold behind what he thought was a successfully dried wall. What started as a relatively simple water extraction job became a much more extensive—and expensive—mold remediation project. The timeline extended from what would have been a 7-day professional restoration to nearly 6 weeks of disruption to his family.

When it comes to restoration timelines, professionals aren't just faster because they do this every day—they're faster because they have the right tools, the right training, and the ability to work on multiple aspects of your project simultaneously. And in restoration, time truly is money—the longer your project takes, the more likely you are to encounter secondary problems that weren't covered in your original insurance claim.

How to Decide: A Homeowner's Checklist

Making the right choice between hiring insurance repair contractors or going the DIY route isn't always straightforward. As I've guided Denver homeowners through this decision, I've found that asking yourself a few key questions can bring remarkable clarity.

Start by honestly assessing the damage severity. When multiple rooms are affected or your home's systems (electrical, plumbing) are compromised, professional help isn't just convenient—it's essential. Similarly, consider the technical complexity involved. While hanging new drywall might seem doable, do you really have the equipment and knowledge to properly test for hidden moisture or safely remove smoke residue?

Health and safety concerns should never be overlooked. I've seen too many well-intentioned homeowners expose themselves to mold spores, asbestos, or unstable structures in an attempt to save money. Your family's wellbeing is simply too important to risk.

Time constraints also play a crucial role. Water damage, in particular, creates a race against the clock—every hour counts when preventing secondary damage like mold growth. As one of our clients recently shared, "I thought I had time to figure things out after our pipe burst. Three days later, we were dealing with mold behind the walls."

Don't forget to check your insurance policy's fine print. Some policies have specific requirements about who performs restoration work, and DIY repairs might affect your coverage. Your personal expertise matters too—previous experience with similar projects can be valuable, but restoration work often involves specialized techniques that differ from standard home improvement.

Financial considerations extend beyond just comparing your deductible to potential DIY savings. Factor in equipment rental costs, material waste from inexperience, and the potential for costly mistakes. Finally, consider whether warranty protection matters to you. Professional insurance repair contractors typically offer multi-year workmanship guarantees that provide valuable peace of mind.

Must-Have Qualifications & Certifications

When you decide professional help is the right choice, not all contractors are created equal. Your home deserves restoration experts with proper credentials and experience.

First and foremost, verify they hold a valid general contractor license in your specific municipality. Denver, Westminster, Thornton, and other Colorado cities each have their own licensing requirements, and a contractor licensed in one area may not be authorized to work in another.

Ask specifically about their insurance restoration experience. A great kitchen remodeler might not understand the nuances of working with insurance companies or properly documenting damage for claims. As one homeowner told me after a difficult experience, "Our contractor was talented but had never worked with insurance before—we ended up having to fight for supplements ourselves."

Industry certifications speak volumes about a contractor's commitment to proper restoration techniques. Look for IICRC certifications relevant to your specific damage type. For water damage, Water Damage Restoration (WRT) and Applied Structural Drying (ASD) certifications ensure they understand the science of proper drying. Fire damage requires Fire and Smoke Restoration (FSRT) certification, while mold issues call for Mold Remediation (AMRT) credentials.

Always request proof of both general liability insurance and bonding. These protections aren't just formalities—they safeguard you if accidents occur during the restoration process. And don't underestimate the value of local reputation; check reviews specifically mentioning insurance restoration work rather than general contracting feedback.

For specialized damage situations, additional credentials become important. HAAG Certification matters for roof inspections, while Asbestos Supervisor Certification is critical for properties built before 1980. If your home is older, Lead-Safe Certification helps ensure safe handling of potentially hazardous materials.

At Accountable Home Services, we've made certification a priority. All our project managers hold multiple IICRC certifications, and we maintain all required licenses for every Denver Metro municipality we serve. This commitment to professional standards isn't just about compliance—it's about delivering restoration work that truly stands the test of time.

10 Questions to Ask Before Signing

Before you commit to any insurance repair contractor, arm yourself with these essential questions. The answers will reveal far more than any sales pitch.

Start with the basics: "How many years have you been a Restoration Contractor?" Experience matters tremendously in this field, and you should look for at least 5+ years specifically handling insurance restoration projects. Follow up by asking whether they specialize in residential or commercial losses to ensure their expertise aligns with your property type.

Don't just take their word for it—request contact information for at least three recent clients with similar insurance projects. A confident, reputable contractor will happily provide references. One of our clients shared how this simple step saved them from hiring a contractor who, they later finded, had numerous complaints about insurance billing practices.

Understanding their documentation process is crucial for a smooth insurance claim. Ask, "How will you document the damage for my insurance company?" Their answer should reveal a systematic approach that captures all damage thoroughly. Similarly, confirm they'll work directly with your insurance adjuster—this direct communication often leads to better outcomes and fewer delays.

The supplement process deserves special attention. Initial insurance assessments frequently miss items, so ask, "What is your process for identifying and requesting supplements?" A contractor who can't clearly explain this likely lacks experience with insurance work.

Unexpected issues almost always arise during restoration, so understand their process for handling change orders. Clear communication about additional costs or timeline changes can prevent misunderstandings later. Warranty protection matters too—look for at least a 2-year workmanship warranty, though the 5-year warranty we offer at Accountable Home Services provides even greater peace of mind.

Project management can make or break your restoration experience. Ask if you'll have a dedicated project manager throughout the process. Having a single point of contact improves communication and accountability dramatically. Finally, get clarity on their payment schedule and whether they offer direct insurance billing, which can significantly reduce your out-of-pocket expenses.

As one restoration expert wisely advised, "Paying a small fee for a separate estimate can yield thousands in additional claim recovery." If you're uncertain about the scope or pricing of your insurance-approved repairs, investing in a second opinion often pays for itself many times over. Your home deserves nothing less than thorough, professional restoration that truly makes you whole again after a loss.

For more detailed guidance on navigating insurance claims, I recommend reading our article on What Every Denver, CO Homeowner Needs to Know About Water Damage Insurance Claims. It provides valuable insights that can help you avoid common pitfalls.

Frequently Asked Questions about Insurance Repair Contractors vs. DIY

Do I have to use my insurer's preferred contractor?

This is probably the most common question I hear from homeowners facing their first major insurance claim. The short answer is no – you absolutely have the right to choose your own contractor.

While your insurance company might strongly recommend their preferred network partners, the final decision rests with you, the homeowner. The Restoration Industry Association makes this crystal clear in their official position: "The adjuster must not instruct or require restoration contractors to remove items from their invoices."

Your insurance company is obligated to cover reasonable costs for proper repairs regardless of who swings the hammer. That said, there's a practical consideration here – using someone outside their network might mean you'll need to pay upfront and then seek reimbursement rather than enjoying the convenience of direct billing.

At Accountable Home Services, we've built relationships with all major insurance companies over the years. Even when we're not in their "preferred" network, we can typically arrange direct billing to make your life easier during an already stressful time.

Can I upgrade materials during an insurance repair?

Yes! And many Denver homeowners don't realize this opportunity exists.

Think of insurance as covering the baseline – restoring your property to its pre-loss condition with "like kind and quality" materials. But this doesn't mean you're stuck with exact replacements if you've been dreaming of upgrades.

Here's how it works in practice: Let's say your water-damaged kitchen had basic laminate countertops. Your insurance will cover replacing those with similar laminate – but if you've always wanted quartz, this is your chance! Your insurance pays the cost of the laminate replacement, and you simply pay the difference for the upgrade.

I've helped countless homeowners turn disaster into opportunity this way. One family in Lakewood had builder-grade carpet damaged in a basement flood. They ended up with beautiful luxury vinyl plank flooring by paying just the difference between what insurance covered and what they truly wanted.

The key is proper documentation – your contractor needs to clearly separate the base repair costs from your chosen upgrades.

How are out-of-pocket costs calculated?

Understanding your true out-of-pocket expenses involves a few moving parts beyond just your deductible.

First, your deductible is non-negotiable – you'll pay this amount regardless of who performs the work. But there are other factors that affect your final costs:

Depreciation often catches homeowners by surprise. Your insurance might initially hold back a portion of your claim as "recoverable depreciation" until the work is completed properly. DIYers frequently struggle to recapture this money, while professional insurance repair contractors understand how to document work to maximize your recovery.

Then there are uncovered items – elements your policy simply doesn't include. Every policy is different, so it's worth reviewing your specific coverage limits.

Finally, any upgrade costs beyond pre-loss condition come from your pocket, as we discussed earlier.

Professional contractors provide clear breakdowns separating insurance-covered expenses from your responsibility. This transparency helps avoid unpleasant surprises and allows for better budgeting.

One crucial warning I share with all my clients: if you receive an insurance payout but don't complete repairs properly, you risk losing recoverable depreciation and potentially violating your policy terms. This is especially important in Colorado, where subsequent damage from improper repairs might not be covered in future claims.

Conclusion

When disaster strikes your home, the path forward isn't always clear. Should you roll up your sleeves and tackle the restoration yourself, or call in the professionals? As we've explored throughout this guide, both approaches have their place—but the stakes are high when it comes to properly restoring your home after damage.

For most Denver homeowners facing significant water damage, fire recovery, or mold issues, the expertise that professional insurance repair contractors bring to the table offers tremendous value that extends far beyond the initial price tag. While the DIY approach might seem like a money-saver at first glance, the specialized equipment, technical knowledge, and insurance navigation skills that professionals offer often deliver better outcomes both immediately and years down the road.

Think about what matters most during a stressful time: getting your home and life back to normal as quickly as possible. Professional restoration teams offer emergency response that prevents secondary damage from developing, apply scientific remediation techniques that ensure thorough restoration, and provide expert insurance navigation that maximizes your claim coverage. Plus, the peace of mind that comes with multi-year warranties can't be underestimated when you're already dealing with the stress of property damage.

As a Denver homeowner myself, I understand our unique regional challenges—from our semi-arid climate that demands specific drying protocols to our local building codes that grow more complex each year. At Accountable Home Services, we've built our family-owned business around addressing these specific needs for our neighbors throughout the Denver Metro Area.

We believe in combining professional expertise with genuine care for our clients. When you're dealing with a burst pipe in Westminster, fire damage in Thornton, or finding mold in your Boulder basement, you deserve a partner who not only knows how to fix the problem but also understands what you're going through emotionally. That's why our certified technicians provide 24/7 emergency response and work directly with your insurance company—we want to make the restoration process as stress-free as possible during an already difficult time.

Our commitment to transparent communication means you'll never be left wondering what's happening with your home. We'll explain every step of the process in plain language, provide regular updates, and make sure you understand your options throughout the project. And our dedication to quality craftsmanship ensures that when we're done, your home isn't just restored—it's protected for the future.

When disaster strikes your home, the first priority is always your family's safety. Once everyone is secure, taking the time to make an informed decision about restoration will help ensure your home returns to its pre-loss condition—or even better—as quickly and smoothly as possible. Whether you choose the DIY route for minor issues or partner with professionals like us for more significant damage, understanding your options is the first step toward recovery.

Ready to learn more about how we can help with your restoration needs? Visit our complete services page to see the full range of solutions we offer Denver homeowners.