Serving Broomfield, Westminster, and Denver Metro Area

Make the first call the

right

call

Blog

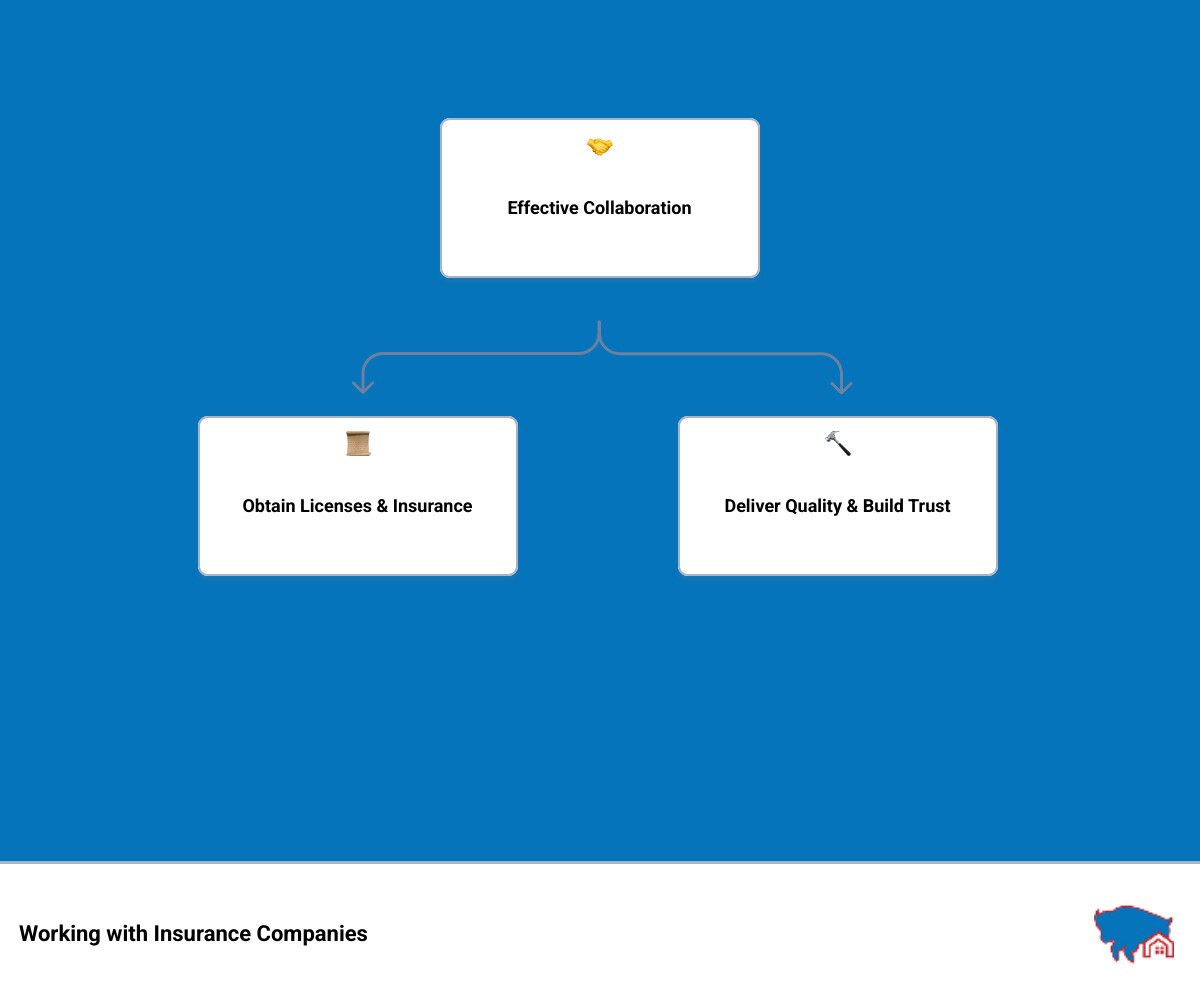

How to work with insurance companies as a contractor isn't just a useful skill—it's a game-changing strategy for expanding your business. At its core, this involves knowing how to effectively steer insurance procedures, while also forging strong partnerships within the industry. Here's what you need to know to get started:

Obtain Necessary Licenses: Ensure you're licensed and insured to protect your business.

Deliver Consistently High-Quality Work: Establish trust by exceeding expectations.

Network with Insurance Professionals: Build relationships with adjusters and other insiders.

Understand Insurance Company Protocols: Respect and adapt to each company’s processes.

Gather Testimonials: Strengthen your credibility with positive reviews.

Working closely with insurance companies provides not only an additional revenue stream but also the opportunity to establish a reputation as a reliable and expert resource for complex insurance-related projects.

I’m Mike Martinez, the owner of Accountable Home Services. With years of experience in emergency restoration and contracting, I've seen how insurance partnerships can lift a business. My goal is to explain how to work with insurance companies as a contractor, helping you open up these benefits for your own business.

How to Work with Insurance Companies as a Contractor

Building Professional Experience

To work with insurance companies as a contractor, build a solid professional foundation. This starts with obtaining the necessary licenses. A contractor's license is essential as it not only demonstrates your qualifications but also assures insurance companies of your credibility.

Equally important is having the right insurance coverage. Contractors insurance, including liability coverage, is a non-negotiable requirement. This coverage protects both you and the clients, instilling trust and reliability.

Delivering high-quality work is crucial. Insurance companies look for contractors who consistently meet or exceed expectations. Aim for excellence in every project, as satisfied clients often lead to positive reviews. These testimonials are powerful tools that can lift your reputation and attract more insurance-related projects.

Networking with Insurance Professionals

Networking is more than just shaking hands and exchanging business cards. It's about creating lasting relationships that can lead to ongoing opportunities. Start by attending industry events and joining professional associations. These platforms offer a wealth of opportunities to meet and connect with insurance agents and adjusters.

Consider joining local insurance associations or attending workshops and trade shows. These events are not just about learning; they are about meeting the right people who can recommend you for projects. Networking is your ticket to new opportunities and collaborations.

Building a network of contacts within the insurance industry can help position you as a preferred contractor. This status can provide a steady stream of projects and improve your standing in the industry.

By focusing on these strategies, you can effectively steer insurance contracting, opening doors to consistent work and boosting your professional reputation. In the next section, we'll explore the essential requirements for contractors, including the importance of business and contractor licenses.

Essential Requirements for Contractors

To thrive as a contractor working with insurance companies, you must first meet a few essential requirements. These form the backbone of your professional credibility and ensure you can operate legally and effectively in your field.

Understanding Insurance Requirements

Before you can even think about landing insurance-related projects, you need to have the right insurance coverage. This typically includes general liability insurance, which protects you from potential lawsuits and damages. It's your safety net, safeguarding both you and your clients.

Compliance with insurance requirements is crucial. Each project might have different insurance needs, so always tailor your coverage to fit. Regularly review your policies to ensure they meet all necessary regulations and standards.

Building a Professional Portfolio

A professional portfolio is more than just a collection of past projects. It's a testament to your skills, experience, and reliability. Insurance companies often look for contractors with a proven track record, so having a strong portfolio is key.

Experience is invaluable. Aim to gather at least five years of experience in your field, which is often a benchmark for becoming a preferred contractor. Diversify your projects to showcase a broad range of skills and expertise.

Testimonials are powerful endorsements. Encourage satisfied clients to provide written feedback on your work. Display these testimonials prominently on your website and marketing materials to build trust with potential insurance partners.

Licenses and Regulations

Operating without the necessary licenses can halt your progress before it even begins. First, secure a business license. This is your legal ticket to operate in your location and is often required by local regulations.

Next, obtain a contractor’s license. This not only demonstrates your competence but also reassures insurance companies of your professionalism. The process usually involves passing an exam and completing specific paperwork.

Staying compliant with local and industry regulations is non-negotiable. These regulations can vary significantly, so stay informed and up-to-date.

By fulfilling these essential requirements, you lay a solid foundation for your contracting business. This credibility is crucial when working with insurance companies, as it positions you as a reliable and professional partner.

In the next section, we will dig into the steps to becoming a preferred contractor, focusing on building a professional reputation and strategic networking.

Steps to Becoming a Preferred Contractor

To become a preferred contractor for insurance companies, you need to focus on building a strong professional reputation and engaging in strategic networking. These steps are key to standing out and securing more opportunities.

Registering Your Business

First things first, ensure your business is legally sound. Registering your business with the relevant authorities is essential. This step not only improves your credibility but also shows that you're a legitimate entity operating within the law.

Legal Compliance: Make sure you have a business license and any necessary contractor’s licenses. This is your legal ticket to work and is often a requirement for insurance companies.

Credibility: Being properly registered adds a layer of trust. Insurance companies prefer to work with contractors who are compliant and reliable.

Maintaining Preferred Status

Once you've achieved preferred status, maintaining it is crucial. Here's how:

Professional Reputation: Deliver high-quality work consistently. Your reputation is built on the reliability and excellence of your projects. Positive reviews and testimonials from past clients can significantly boost your standing.

Customer Service: Exceptional customer service is a must. Understand your clients' needs and exceed their expectations. Prompt communication and transparency build trust and satisfaction.

Industry Standards: Stay updated with the latest industry standards and regulations. Obtain necessary certifications and licenses specific to your field. This shows your commitment to professionalism and continuous improvement.

Strategic Networking

Networking is your gateway to new opportunities. It's not just about meeting people; it's about building relationships that can lead to long-term partnerships.

Industry Events: Attend local conferences, workshops, and trade shows. These are great places to meet insurance agents and adjusters who can become valuable contacts.

Professional Associations: Join associations that cater to insurance professionals. These platforms offer networking opportunities and insights into industry trends.

By focusing on these steps, you can position yourself as a top choice for insurance companies. This approach not only increases your project opportunities but also solidifies your standing in the industry.

In the next section, we'll explore tips for landing insurance restoration jobs and how you can make the most of these opportunities.

Tips for Landing Insurance Restoration Jobs

Securing insurance restoration jobs can be a game-changer for contractors. These projects are often large and come with guaranteed payments. Here's how to stand out and land these lucrative opportunities.

Avoiding Common Mistakes

1. Don't Turn Away Clients Pre-Claim:One common mistake is refusing clients who haven't filed an insurance claim yet. Instead, assist them in the claim process. This not only increases your chances of securing the job but also builds trust with both the client and the insurance company.

2. Avoid Overpromising:It’s tempting to offer low estimates to win jobs. But overpromising and under-delivering can harm your reputation. Insurance agents and adjusters value accurate estimates. This reliability can lead to more opportunities in the future.

3. Provide Accurate Estimates:Accurate estimates are crucial for maintaining credibility. Before giving an estimate, thoroughly inspect the damage and understand the scope of work. Use technology like estimating software to ensure precision and efficiency.

Networking with Insurance Agents

Building relationships with insurance agents and adjusters can open doors to more jobs. Here’s how to network effectively:

1. Attend Industry Events:Participate in local conferences, workshops, and trade shows. These events are excellent venues to meet insurance professionals who can refer you for future projects.

2. Join Professional Associations:Being part of professional associations gives you access to valuable connections and insights into industry trends. These associations often host events and seminars that are perfect for networking.

3. Foster Relationships:Networking isn’t just about meeting people; it’s about building lasting relationships. Follow up with contacts you meet, and maintain regular communication. This establishes you as a reliable and professional choice for insurance restoration jobs.

By avoiding common mistakes and focusing on building strong relationships, you can increase your chances of landing insurance restoration jobs. In the next section, we'll address some frequently asked questions about working with insurance companies.

Frequently Asked Questions about Working with Insurance Companies

How do contractors get paid from insurance companies?

When working with insurance companies, contractors often receive payments directly from the insurer. Here's how it typically works:

Payment Processing: After completing the work, contractors submit an invoice to the insurance company. This invoice should detail the work done and the costs involved. It's crucial to be thorough and accurate to avoid delays.

Direct Payment: In many cases, the insurance company will pay the contractor directly. This streamlines the process and ensures that contractors receive payment promptly. Make sure to have a clear agreement with the policyholder and the insurer about how payments will be handled.

Milestone Payments: For larger projects, insurance companies might release payments in stages. These are known as milestone payments and are tied to the completion of specific phases of the project.

Can a contractor be an insurance adjuster?

It's important to understand the distinction between contractors and insurance adjusters:

Unauthorized Practice: Contractors are not licensed to adjust claims. This means they can't negotiate or settle claims on behalf of the insured. Doing so can lead to legal issues and is considered the unauthorized practice of public adjusting.

Public Adjusting: Only licensed public adjusters can legally adjust claims for the policyholder. They work to ensure the policyholder receives the maximum settlement. Contractors should focus on their role in repairs and restoration, leaving claim adjustments to the professionals.

What not to tell your contractor?

Clear communication with your contractor is key to a successful project, but there are some things you should avoid saying:

Avoid Sharing Insurance Payout Details: It's best not to disclose the exact amount your insurance company is paying. This ensures that the contractor's estimate is based on the actual work needed, not the available funds.

Unrealistic Expectations: Be clear about what you expect, but avoid making demands that are outside the scope of the insurance coverage or the contractor's expertise. This helps maintain a good working relationship and ensures that the project stays on track.

Don't Make Assumptions: Never assume that the contractor understands all your needs without clear communication. Discuss your expectations, timelines, and any specific requirements upfront to avoid misunderstandings.

By understanding these aspects of working with insurance companies, contractors can steer projects smoothly and avoid common pitfalls. In the next section, we'll dig into the essential requirements for contractors to work effectively with insurers.

Conclusion

At Accountable Home Services, we pride ourselves on our commitment to delivering top-notch restoration services in the Denver Metro Area. Our expertise in water, fire, mold, and asbestos remediation ensures that we provide reliable and efficient solutions custom to meet the needs of our clients. We understand that dealing with property damage can be stressful, which is why we offer 24/7 emergency response and direct insurance billing to ease the burden on homeowners.

Our team of certified technicians uses state-of-the-art equipment and follows strict safety standards to ensure each project is completed thoroughly and promptly. This dedication to quality craftsmanship and transparent communication has made us a trusted partner for countless homeowners seeking restoration and remodeling services.

By focusing on building strong relationships with insurance companies and consistently delivering high-quality work, we strive to be the preferred contractor for insurance restoration jobs. Our approach combines professional expertise with a genuine commitment to customer satisfaction, ensuring that we not only meet but exceed expectations.

For more information about our services and how we can assist you with your restoration needs, visit our services page. Let us help protect and improve your home with solutions that you can trust.

SERVICE AREA

SERVING BROOMFIELD, WESTMINSTER, AND DENVER METRO AREA

Accountable Home Service services all of Denver Metro Area.

Below are some of the most common cities we work in!

SERVICE AREA

Don’t see your service area? We May still service your location. To know for sure, give us a call 720-620-3272 or complete the form on our contact Page and we’ll let you know.

100+ Clients Served

WHY CHOOSE US

What Makes Us The Accountable Home Services?

Family Owned

Proudly family-owned and operated, our company brings the values of service, integrity, and excellence to every job. We understand the importance of trust and reliability, especially when it comes to home restoration.

100% Free Estimates

We offer no-obligation, 100% free estimates to ensure you can plan your restoration with complete financial transparency. Our assessments are thorough, honest, and always upfront.

Fast Response Times

Rapid response is crucial in a crisis, and our team is committed to being there swiftly to minimize damage. We're ready around the clock, ensuring your emergency is tackled with urgency.

IICRC & IRI Certified

Each service is performed by our licensed and certified professionals, ensuring industry-standard quality. We pride ourselves on a skilled team equipped to handle your restoration needs expertly and efficiently.

CONTACT US

Get a Free Estimate Today

Contact us today at 720-620-3272 for all your restoration and clean-up needs in Denver, CO, and the surrounding areas.

CONTACT DETAILS

Phone:

Accountable Home Services

Accountable Home Services is a trusted national leader in the disaster restoration industry. Accountable Home Services currently has open opportunities nationwide.

IICRC Certified

Schedule an Appointment 24/7

We’re here to help with your restoration and clean-up needs around Denver, CO, and nearby areas. Reach out to our team 24/7 for prompt, professional service tailored to your situation or call 720-620-3272

Contact Us

We will get back to you as soon as possible.

Please try again later.