Blog

When considering how to get restoration work from insurance companies, focus on three key strategies: networking with industry professionals, understanding the insurance claims process, and delivering exceptional customer service. Developing strong relationships with adjusters and offering seamless experiences can help restoration contractors secure more jobs. By integrating these strategies into your business practices, you'll increase your chances of gaining access to lucrative insurance restoration work.

Networking plays a crucial role in building connections that lead to preferred contractor status. Engaging with local insurance agents and adjusters can open doors to new opportunities. Understanding the nuances of the insurance system is equally vital. It enables you to provide accurate, reliable estimates that align with insurance company expectations. Additionally, customer service can't be overlooked. Stellar service and clear communication differentiate your business and build trust with both clients and insurance professionals.

I'm Mike Martinez, owner of Accountable Home Services. With a background in restoration and a commitment to partnering with insurance companies, I've honed my expertise in how to get restoration work from insurance companies. My team and I stand ready to streamline your claims process and deliver top-quality service, custom for the unique demands of Denver-area homeowners.

Understanding the Insurance System

Navigating the insurance system can seem daunting, but understanding a few key components can make all the difference. Let's break down the claims process, introduce some essential insurance terms, and explain the role of adjusters.

The Claims Process

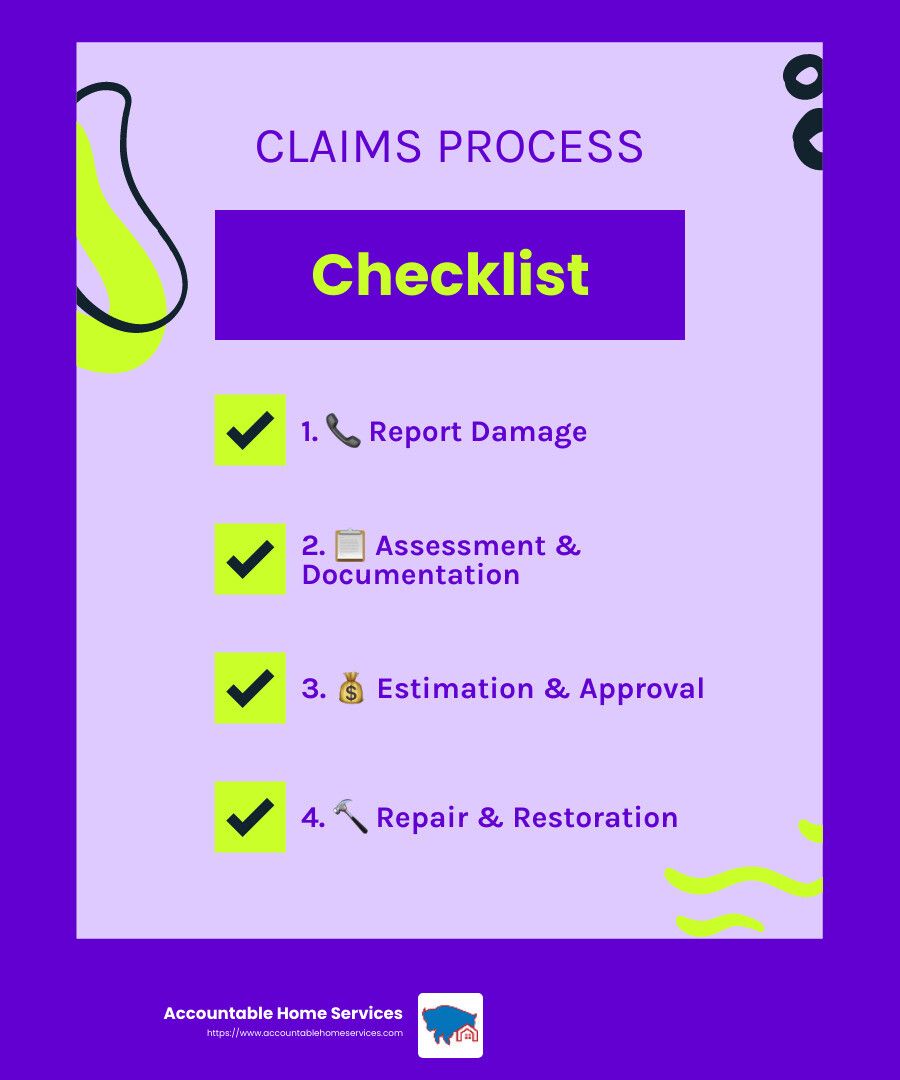

When disaster strikes, the first step is often filing an insurance claim. This process involves several stages:

- Reporting the Damage: Homeowners contact their insurance provider to report the damage. This step is crucial for initiating the claims process.

- Assessment and Documentation: An insurance adjuster visits the property to assess the damage. It's important for restoration professionals to be present during this assessment to ensure all damages are accurately documented.

- Estimation and Approval: Restoration companies provide a detailed estimate of the repair costs. Insurance companies review these estimates to approve the claim amount.

- Repair and Restoration: Once approved, restoration work begins. It's vital to maintain clear communication with both the homeowner and the insurance company throughout this phase.

- Final Inspection and Payment: After repairs are completed, a final inspection ensures all work meets the agreed standards. The insurance company then releases the payment to cover the restoration costs.

Key Insurance Terms

Understanding specific insurance terms can help streamline communication and avoid misunderstandings:

- Premium: The amount paid by the policyholder for insurance coverage.

- Deductible: The out-of-pocket cost that the policyholder must pay before insurance coverage kicks in.

- Policy Limit: The maximum amount an insurance company will pay for a covered loss.

- Exclusions: Specific conditions or circumstances not covered by the policy.

The Role of Adjusters

Adjusters play a pivotal role in the insurance claims process. They are responsible for evaluating the damage and determining the amount the insurance company will pay. Here's how they fit into the process:

- Damage Assessment: Adjusters inspect the property and assess the extent of the damage.

- Documentation: They gather evidence, such as photos and reports, to document the damage.

- Negotiation: Adjusters work with contractors to agree on the repair costs.

Building a strong relationship with adjusters can be beneficial. It helps ensure a smooth claims process and can lead to more restoration work opportunities. By understanding their role and communicating effectively, restoration companies can position themselves as valuable partners in the insurance process.

How to Get Restoration Work from Insurance Companies

Landing restoration work from insurance companies can be a lucrative opportunity for contractors. But how do you get your foot in the door? Let's break it down into three key areas: networking, becoming a preferred contractor, and creating a seamless process.

Networking

Networking is your first step. Building relationships with insurance agents and adjusters is crucial. Attend local industry events and join associations where these professionals gather.

Why? Because most claims adjusters have a list of preferred contractors. By networking, you increase your chances of being included on these lists.

Being on a preferred list means more job opportunities and a steady stream of work.

Becoming a Preferred Contractor

To become a preferred contractor, you need to stand out. Here's how:

- Showcase Your Expertise: Highlight your skills and experience in restoration work. Use case studies or past projects to demonstrate your capabilities.

- Offer Accurate Estimates: Insurance companies value contractors who provide precise and reliable estimates. Overpromising and under-delivering is a common mistake. Avoid it by being honest and transparent.

- Deliver Exceptional Customer Service: Insurance agents want to refer contractors who make them look good. Providing outstanding service can set you apart from the competition.

Creating a Seamless Process

Having a seamless process is vital. It not only impresses insurance companies but also ensures a smooth experience for homeowners. Here's how to streamline your operations:

- Efficient Communication: Keep all parties informed at every stage. Use platforms like DASH to manage updates and keep everyone in the loop.

- Quick Response Times: In emergencies, speed is critical. Ensure your team can respond promptly to minimize damage and start restoration work quickly.

- Compliance with Regulations: Familiarize yourself with any regulations or requirements that third-party administrators (TPAs) may have. TPAs often handle the administrative workload for insurance carriers, and compliance is key to maintaining relationships with them.

By focusing on these areas, you can position your company as a top choice for insurance restoration work. It's not just about being available; it's about being the best option.

Next, we'll dive into building strong relationships with insurance agents and adjusters to further solidify your standing in the industry.

Building Strong Relationships with Insurance Agents and Adjusters

Establishing strong relationships with insurance agents and adjusters is crucial for securing restoration work from insurance companies. These relationships can lead to mutual benefits and a steady flow of projects.

Networking

Start by networking strategically. Attend local industry events and join associations where insurance professionals gather. Participating in these events not only helps you meet potential partners but also keeps you informed about industry trends.

Example: Consider joining local chapters of insurance-related associations or attending seminars and workshops. These gatherings are excellent places to meet agents and adjusters who can refer you to homeowners needing restoration services.

Networking is not just about exchanging business cards. It's about building genuine connections. Take the time to follow up with contacts and nurture these relationships over time.

Local Associations

Being active in local associations can greatly improve your visibility and credibility. These organizations often host events, training sessions, and networking opportunities. By being an active member, you position yourself as a knowledgeable and reliable partner in the restoration field.

Tip: Offer to speak at association events or write articles for their newsletters. Sharing your expertise helps establish you as a thought leader in the industry.

Mutual Benefits

The goal is to create a win-win situation. Insurance agents and adjusters are more likely to work with contractors who make their jobs easier. Here’s how to achieve this:

- Reliable Communication: Keep agents and adjusters updated on the progress of restoration projects. Use tools like DASH to provide real-time updates and ensure everyone is on the same page.

- Prompt Problem Solving: Address any issues swiftly and efficiently. When problems arise, take ownership and resolve them without delay. This builds trust and shows that you’re a dependable partner.

- Consistency in Quality: Deliver high-quality work consistently. When agents and adjusters know they can count on you for excellent results, they’re more likely to refer you to their clients.

Building these relationships takes time, but the effort pays off. By being proactive and demonstrating your value, you’ll become a preferred partner for insurance professionals, leading to more restoration opportunities.

Next, we'll explore how providing exceptional customer service can further improve your reputation and success in the insurance restoration industry.

Providing Exceptional Customer Service

Delivering exceptional customer service is key to succeeding in the insurance restoration industry. It's not just about fixing what's broken; it's about creating a positive experience for everyone involved.

Customer Experience

A great customer experience starts with understanding the emotional state of your clients. When homes are damaged, homeowners are often stressed and anxious. Your role is to provide reassurance and support throughout the restoration process.

- Be empathetic: Listen to your clients' concerns and show understanding. This builds trust and makes them feel valued.

- Communicate clearly: Keep customers informed at every stage. Regular updates help alleviate their worries and keep the process transparent.

Example: A restoration company in Denver gained loyal customers by sending daily updates via text messages. This simple act of communication made a huge difference in customer satisfaction.

Accurate Estimates

Providing accurate estimates is crucial. It sets the right expectations and avoids surprises down the road. Insurance agents and adjusters appreciate precise estimates because it makes their job easier and builds trust.

- Be thorough: Take the time to assess the damage properly. A detailed estimate shows professionalism and reduces the likelihood of disputes.

- Avoid overpromising: It's better to underpromise and overdeliver. Set realistic timelines and budgets, and aim to exceed them.

Tip: Use software tools to help generate accurate estimates. This not only saves time but also reduces human error.

Communication

Effective communication is the backbone of exceptional customer service. It ensures that everyone—homeowners, agents, and adjusters—is on the same page.

- Be accessible: Make it easy for clients to reach you. Whether it's a phone call, email, or text, being available builds confidence.

- Use technology: Platforms like DASH keep everyone updated on project progress. This transparency is appreciated by insurance professionals and policyholders alike.

Case Study: A restoration company in Boulder improved its client retention by implementing a simple online portal where clients could track their project's progress. This proactive approach to communication set them apart from competitors.

By focusing on these areas, you can improve your reputation as a reliable and customer-focused restoration company. Next, we'll address some frequently asked questions about insurance restoration to further clarify how these processes work.

Frequently Asked Questions about Insurance Restoration

Understanding the ins and outs of how to get restoration work from insurance companies can be tricky. Here, we answer some common questions to help clarify the process.

How do restoration companies work with insurance?

Restoration companies often work closely with insurance companies to streamline the approval, payment, and estimate processes. Here's how it typically works:

- Approval: Once a homeowner files a claim, an insurance adjuster assesses the damage. The restoration company then provides an estimate for repairs. After the adjuster approves this estimate, work can begin.

- Payment: Insurance companies usually pay the restoration company directly. Sometimes, they might issue a check to the homeowner, who then pays the contractor. It's essential to understand the payment method to avoid confusion.

- Estimates: Accurate estimates are vital. They help set realistic expectations for both the homeowner and the insurer. Restoration companies should ensure their estimates are detailed and align with the adjuster's assessment to avoid delays.

By following these steps, restoration companies can ensure a seamless process, making it easier for everyone involved.

Is restoration covered by insurance?

Whether restoration is covered by insurance depends on several factors:

- Sudden Damage: Most insurance policies cover sudden and accidental damage, like a burst pipe or a fire. In these cases, restoration work is typically covered.

- Negligence: Damage resulting from neglect, such as failing to fix a known leak, is usually not covered. Homeowners need to maintain their properties to avoid these issues.

- Coverage: It's crucial for homeowners to understand their policy coverage. Some damages, like those from natural floods, might require additional policies, such as flood insurance. Learn more about what typical policies cover.

Why would an insurance company not want to settle?

Sometimes, insurance companies may hesitate to settle a claim due to various reasons:

- Medical Records: In cases involving personal injury, incomplete or missing medical records can delay settlements. Insurers need comprehensive documentation to proceed.

- Exaggeration: If they suspect the claim is exaggerated, insurers will investigate further. This can slow down the process as they verify the details.

- Settlement: Insurance companies aim to minimize payouts. If they believe a claim is overstated, they might offer a lower settlement or deny it altogether.

Understanding these factors helps restoration companies and homeowners steer the claims process more effectively, ensuring a smoother experience for all parties involved.

Next, we'll dig into how building strong relationships with insurance agents and adjusters can further benefit your restoration business.

Conclusion

Accountable Home Services is committed to creating successful partnerships with insurance companies, ensuring long-term success for our business and peace of mind for our clients. Our approach is built on trust, expertise, and a deep understanding of the insurance restoration process. By maintaining strong relationships with insurance agents and adjusters, we position ourselves as the go-to restoration company in the Denver Metro Area.

Partnerships with insurance companies are crucial. They not only provide a steady stream of restoration jobs but also reinforce our reputation as a reliable and efficient service provider. Our family-owned business understands the value of trust and integrity, which is why we work tirelessly to uphold these values in every job we undertake. By collaborating closely with insurance professionals, we ensure that claims are handled smoothly, and clients receive the best possible service.

Long-term success in the restoration industry relies on consistent quality and customer satisfaction. At Accountable Home Services, we use cutting-edge equipment and certified professionals to deliver top-notch restoration services. Our commitment to transparent communication and prompt response times ensures that our clients are always informed and reassured throughout the restoration process.

By focusing on building strong partnerships and delivering exceptional service, Accountable Home Services is well-positioned for continued growth and success in the restoration industry. We invite you to explore our services and find how we can help restore and improve your home.